With the NFL season starting in just over two weeks, bettors across the United States are preparing to wager on the nation's most popular sport.

More people have access to online betting now than ever before as more states continue to legalize it. In addition, sportsbooks offer lucrative sign-up bonuses and other promotions to entice new bettors to join their platforms. The competition doesn't seem to be ending any time soon, either, as industry giants like ESPN are looking to get in on the action.

With the recent economic downturn and inflation levels being the highest it's been since 1981, however, many consumers' wallets and pocketbooks are feeling a bit lighter. A Morning Consult study found that two-thirds of consumers are taking steps to spend less due to inflation.

To find out how the economy is affecting sports betting, as well as answers to many other questions, we surveyed 660 adults in the U.S. that regularly bet on sports.

Our survey results shed light on how people plan to bet this upcoming NFL season, if they would use an ESPN-branded sportsbook, if they're going into credit card debt for betting, and much more.

Key Findings

Sports betting during the recession and high inflation levels

- 81.4% of respondents said that high inflation levels and the recession in the U.S. have negatively affected their financial situation.

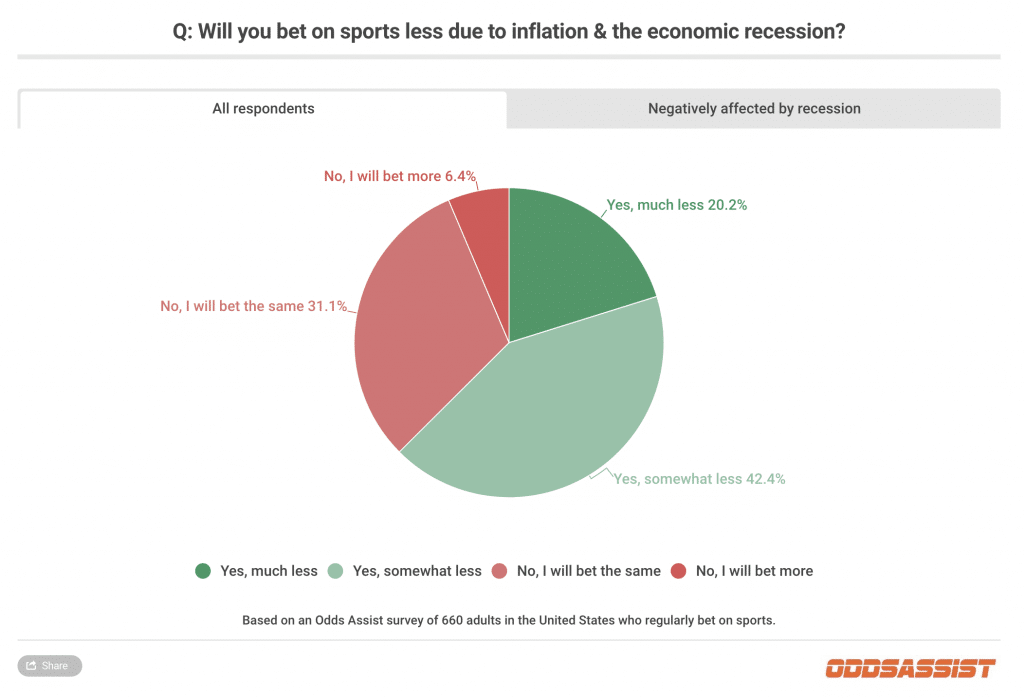

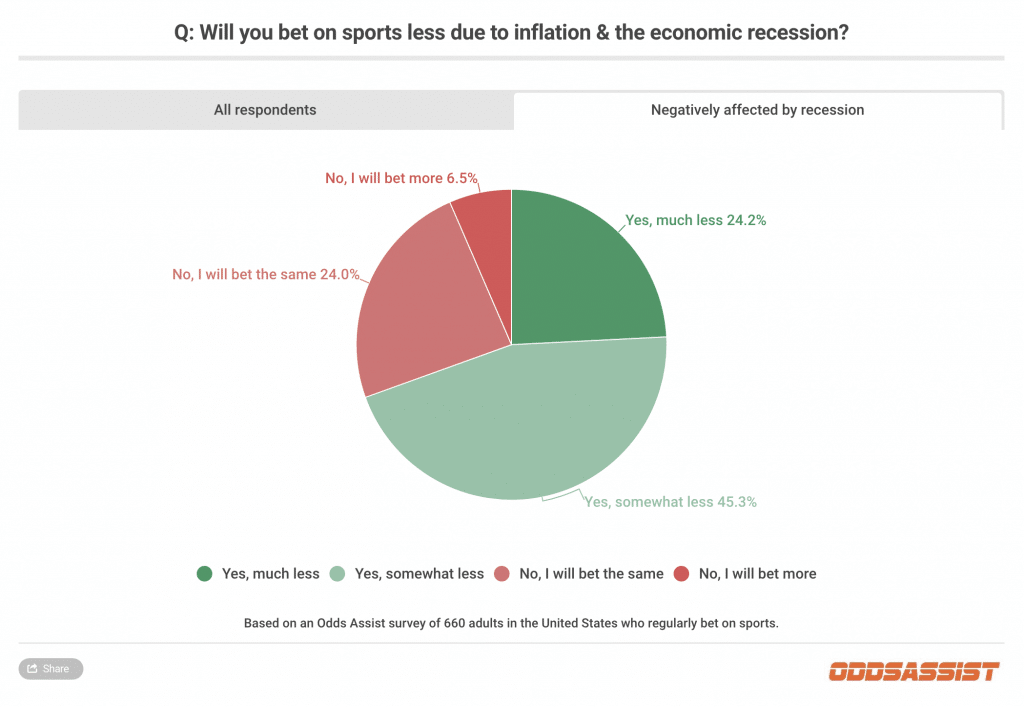

- Of those respondents, 24.2% plan to bet much less on sports due to the high inflation and the recession, 45.3% plan to bet somewhat less, 24.0% plan to bet the same, and 6.5% plan to bet more.

- When looking at all respondents, 20.2% plan to bet much less, 42.4% plan to bet somewhat less, 31.1% plan to bet the same, and 6.4% plan to bet more.

- Jump down to section

Sports bettors using credit cards to deposit into their accounts and going into debt as a result

- 57.1% of respondents indicated that they have used a credit card to deposit into their sportsbook accounts in the past.

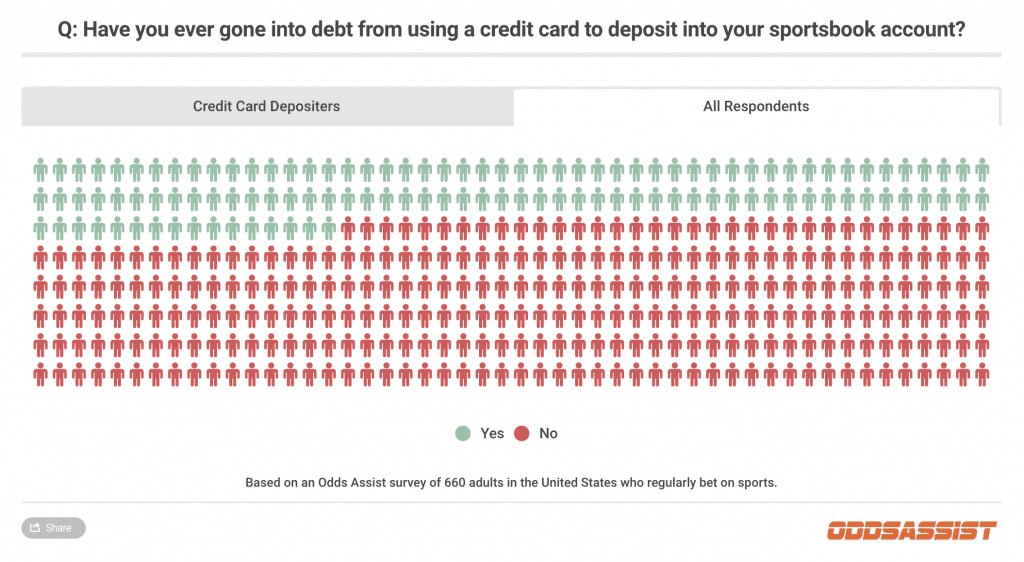

- Of those, 50.7% said that they have gone into credit card debt as a result.

- When factoring in those that haven't used a credit card to deposit, we found that 28.9% of all sports bettors have gone into credit card debt as a result of sports betting.

- Jump down to section

Bettors’ thoughts on a potential ESPN Sportsbook

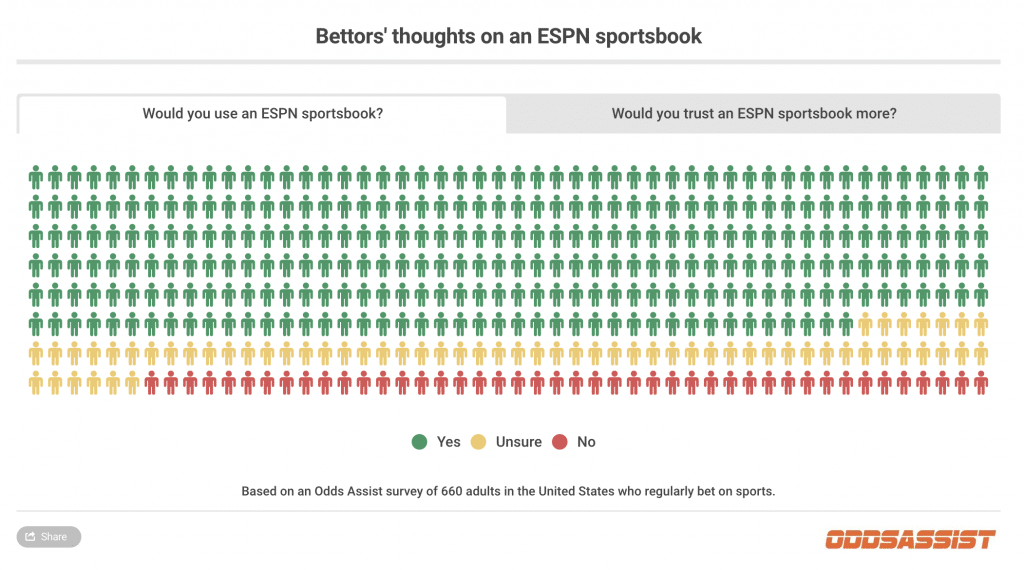

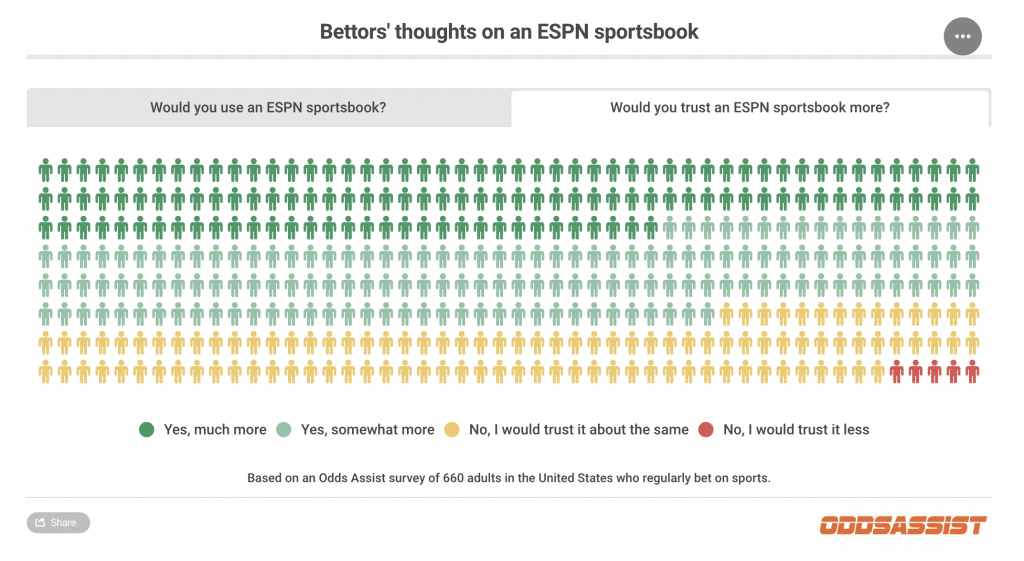

- 73.3% of respondents said they would use an ESPN-branded sportsbook, while 10.9% wouldn’t use it and 15.8% are unsure.

- 71.5% of respondents said they would trust an ESPN sportsbook more than other options.

- Jump down to section

Other interesting betting trends

- 72.7% of bettors bet on their favorite teams “much more” (38.0%) or “slightly more” (34.7%) than other teams.

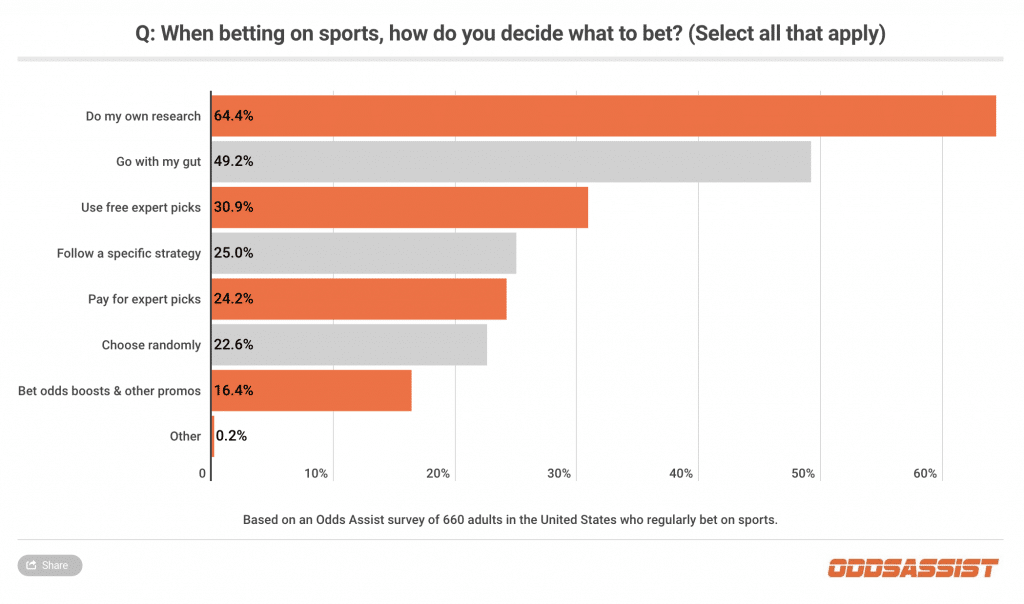

- 64.4% of bettors do their own research to decide what to wager on, 24% pay for picks, and 22.6% choose randomly.

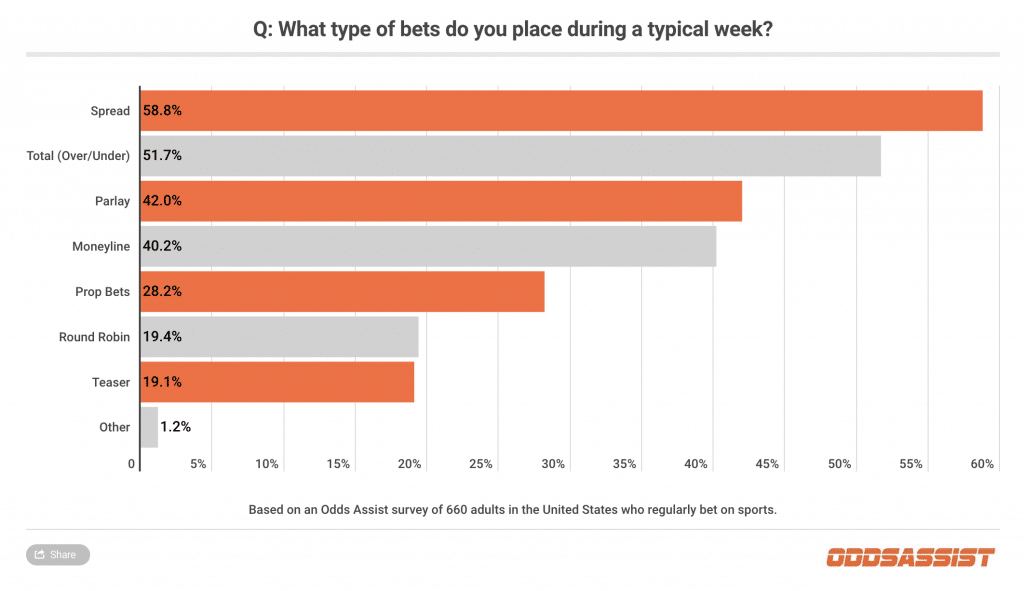

- Spread bets (58.8%) are the most common type of wager respondents make in a typical week, followed by totals (51.2%), parlays (41.2%), moneyline bets (40.2%), and prop bets (28.2%).

- The average betting unit of our respondents is $172 while the median is $50.

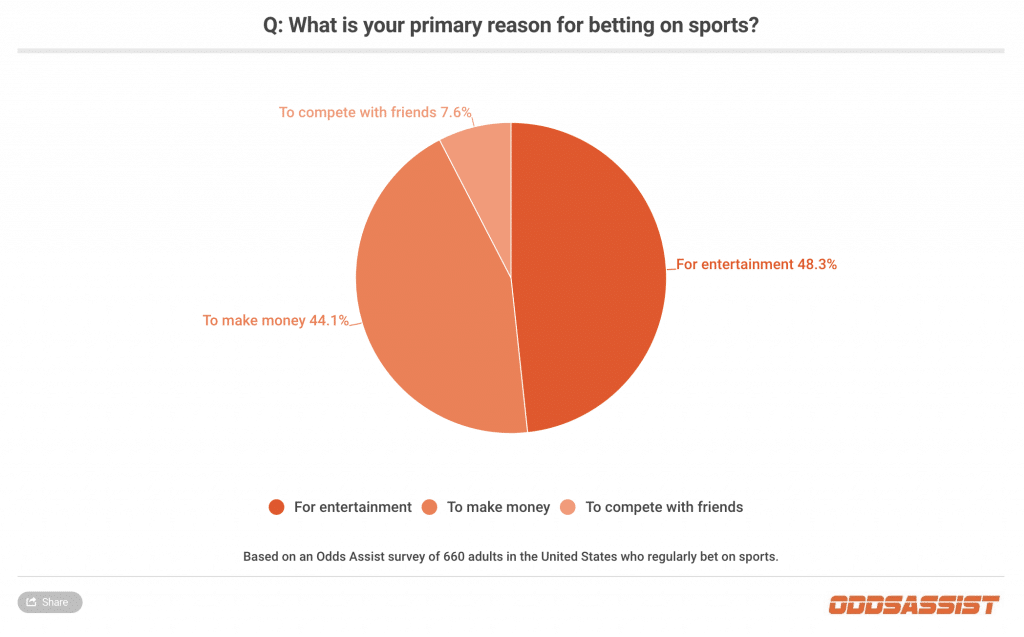

- When asked what their primary reason for betting on sports is, 48.3% of respondents said do it “for entertainment,” 44.1% do it “to make money,” and 7.6% do it “to compete with friends.”

- When choosing a sportsbook, here's what matters the most to bettors: how competitive the odds are (23.2%), how valuable the sign-up bonus is (21.4%), how nice the user experience is (18.3%), how many ongoing promotions and odds boosts there are 15.5%), how fast the sportsbook pays out (15.2%), and if they recognize the name (6.2%).

- Jump down to section

How the Recession & High Inflation Levels in the U.S. Are Affecting Sports Betting

As mentioned in the intro, inflation is the highest it's been since 1981, causing living expenses to go up considerably for consumers.

In addition, the United States' Gross Domestic Product (GDP) has fallen for two consecutive quarters. While some argue that this doesn't necessarily mean we're in a recession, it has been a generally accepted definition by many.

Either way, it's safe to say that the economy isn't in the best spot right now and Americans are facing higher prices for almost all types of goods and services.

So how is this affecting sports betting?

Our first question asked respondents if they've been negatively affected by high inflation levels and the recession.

Over 80% of respondents said their financial situation has been negatively affected by high inflation levels and the recession, with 40.8% saying they've been affected very much and 40.6% saying they've been affected somewhat.

Next, we asked if bettors are planning to bet less as a result. We broke the results down by all respondents and those who said they have been negatively affected by inflation and the recession:

These results may bring discomfort to sports betting companies who rely heavily on successful NFL and college football betting seasons—both of which are right around the corner.

Since the NBA and NHL playoffs ended in June, the MLB has been the only major U.S. sport available for betting. This may have been making it difficult for sportsbooks to gauge how the economy is changing bettors' habits.

Our results indicate that the economy is directly impacting how much people bet, with over 60% of respondents saying they will bet less.

Bettors Going into Credit Card Debt for Sports Betting

Almost all online sportsbooks offer a variety of methods for customers to deposit money into their accounts.

For example, FanDuel's deposit options include bank transfer, debit card, credit card, PayPal, Play+ card, cash at a physical sportsbook, check, wire transfer, and more.

One of these deposit methods is unlike the others.

While all of the other options require you to have the money on hand to deposit, credit cards are a line of credit that you can pay back later. If you don't pay off your balance in full for that month, you're charged interest rates that are around 18%, on average, with many cards having much higher rates.

Credit card debt is one of the most expensive forms of debt and can lead to a debt spiral that can be incredibly difficult to get out of. Combining the ability to spend without the money on hand with the addictive nature of gambling is a scary proposition.

We asked the next set of questions to find out how big of an issue this may be.

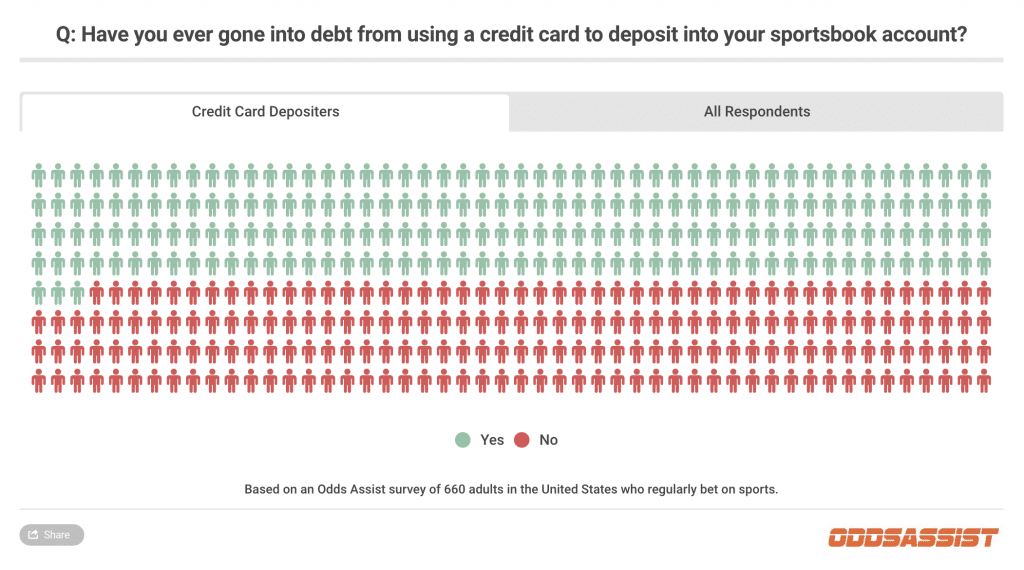

First, we asked respondents if they've ever used a credit card to deposit into their sportsbook account, 57.1% of which have.

Next, we asked this group if they've gone into debt as a result of using a credit card to deposit into their sports betting account:

As shown in the graphic above, over half (50.7%) of those that have used a credit card to deposit into their sportsbook account have gone into debt as a result.

When accounting for respondents who haven't used a credit card as a deposit method, we can say that 28.9% of sports bettors have gone into credit card debt to deposit money into their accounts.

Oddsmakers have access to countless amounts of data, complex models, and many other tools that help them set razor-sharp lines and odds. This makes it incredibly difficult for average sports bettors to turn a profit over time. Being charged an 18% interest rate (or higher) on the money in your sports betting account makes it nearly impossible.

What's even scarier is that some bettors try to chase their losses, meaning they place more bets to try to make up for losing bets. This can lead to even more credit card debt and a much bigger problem.

It's not hard to see why using a credit card to deposit into a sports betting account can lead to insurmountable financial issues and problematic gambling. If states truly have their residents' best interest in mind, they may want to ban credit card deposits, as Connecticut, Iowa, New York, and Tennessee already have.

Bettors Would Be Very Supportive of an ESPN Sportsbook

ESPN first showed interest in joining the burgeoning sports betting industry in August 2021 when it announced that it was seeking to license its brand to a sportsbook for at least $3 billion.

While no such deal has been completed yet, ESPN president Jimmy Pitary recently told The Athletic that sports betting is not a “nice to have” for the company, but rather a “must-have.”

While ESPN has marketing deals with Caesars and DraftKings in place, no “ESPN Sportsbook” exists yet.

(Editor's Note: There is now a sportsbook with ESPN's name on it called ESPN BET. Read our ESPN BET review to learn more about how it came to be).

With renewed rumblings of ESPN looking to partner with an existing sportsbook or launch a sportsbook otherwise, we wanted to find out what current sports bettors thought of a potential ESPN-branded sportsbook.

We asked respondents if they would use an ESPN sportsbook and if they would trust an ESPN sportsbook more than other options:

As shown in the graph above, an ESPN-branded sportsbook would be a hit among bettors, with 73.3% saying they would use it and only 10.9% saying they would not. In addition, 71.5% of bettors said they would trust an ESPN sportsbook more than other options.

Though ESPN would be late to the game in terms of launching a sportsbook, it seems that the renowned brand would carry the company to having one of the largest market shares of all sportsbooks.

Question 8 of our survey found the most popular sportsbooks used by our respondents are DraftKings (66.5%) and FanDuel (62.7%). Since we found that over 73% of bettors would use an ESPN sportsbook, this would put them at number one in terms of the proportion of bettors using it.

It wouldn't be surprising to see a company like PointsBet, bet365, WynnBET, Rush Street Interactive (owners of BetRivers and SugarHouse), or another lesser-known sportsbook partner with ESPN to dramatically increase its customer base.

Other Sports Betting Insights from the Survey

We asked a number of other questions to get more insight into the habits of sports bettors, including how they decide what to bet on, how much and how often they bet, and how they choose sportsbooks.

You can see all of the questions and responses in our full survey results or read about some of the most interesting insights below.

One of our questions found that the vast majority of bettors are wagering for the entertainment (48.3%) or to make money (44.1%):

The entertainment aspect isn't particularly surprising. If you've ever bet on a game—even if you wouldn't care about it otherwise—you know how exhilarating it can be.

The making money part, on the other hand, is pretty surprising. As mentioned earlier, oddsmakers are typically very good at their jobs, making it hard for sports bettors to overcome the vig (what sportsbooks charge to take your bets) and be profitable over time.

Next, we asked respondents what types of sports bets they place in a typical week:

Unsurprisingly, spread bets and total bets led the way at 58.8% and 51.7%, respectively. These are typically the bets that experts talk about when giving picks, what pick'em contests use, and what sportsbooks make the most prominent when viewing a game.

After that, parlays and moneyline bets both came in just over 40%, followed by prop bets (28.2%), round robin bets (19.4%), and teasers (19.1%).

The last question we'll highlight in this section asked bettors how they decide what to bet on. Note that respondents were allowed to select all of the options that applied to them, so percentages total up to more than 100%.

Based on our results, it seems that nearly half of bettors are either doing their own research (64.4%) or going with their gut (49.2%) when placing bets. While these strategies are quite the opposite, it's likely that many bettors may do research for some picks and go with their gut for others.

After those two, a considerable amount of bettors use expert picks—whether free (30.9%) or paid (24.2%)—follow a specific strategy such as fading the public (25.0%), or bet odds boosts and other promotions (16.4%).

Perhaps most surprising of all, however, was that nearly a quarter of respondents (22.6%) just choose randomly when placing bets. With how difficult betting on sports can be sometimes, maybe that isn't a bad strategy after all.

Full Survey Results

1) Has your financial situation been negatively affected by high inflation levels and the economic recession in the United States?

- Yes, very much so – 40.8%

- Yes, somewhat – 40.6%

- No, my financial situation is about the same – 15.8%

- No, my financial situation has improved – 2.9%

2) Will you bet on sports less due to high inflation levels and the economic recession? (Parentheses are only respondents who answered “Yes” to Q1.)

- Yes, much less – 20.2% (24.2%)

- Yes, somewhat less – 42.4% (45.3%)

- No, I will bet the same – 31.1% (24.0%)

- No, I will bet more – 6.4% (6.5%)

3) When betting on sports, do you bet on your favorite team more than others?

- Yes, I bet on my favorite team much more than other teams – 38.0%

- Yes, I bet on my favorite team slightly more than other teams – 34.7%

- No, I bet my favorite team about the same as any other team – 20.2%

- No, I bet on my favorite team less than other teams – 5.9%

- No, I never bet on my favorite team – 1.2%

4) When betting on sports, how do you decide what to bet? (Select all that apply)

- I go with my gut – 49.2%

- I do my own research by looking at statistics and scores – 64.4%

- I pay for expert picks – 24.2%

- I use free expert picks – 30.9%

- I choose randomly – 22.6%

- I follow a specific strategy (such as fading the public) – 25.0%

- I mainly bet odds boosts & other promotions – 16.4%

- Other – 0.2%

5) What type of sports bets do you place during an average week? (Select all that apply)

- Spread – 58.8%

- Total (Over/Under) – 51.7%

- Moneyline – 40.2%

- Parlay – 42.0%

- Prop Bets – 28.2%

- Teasers – 19.1%

- Round Robin – 19.4%

- Other – 1.2%

6) How many sportsbooks do you use?

- 1 – 19.9%

- 2 – 43.3%

- 3 – 19.1%

- 4 – 11.5%

- 5 – 3.9%

- 6+ – 2.3%

7) Do you compare odds & lines at sportsbooks before placing your bets?

- Yes, always – 12.9%

- Yes, most of the time – 23.0%

- Sometimes – 46.7%

- Rarely – 13.0%

- No, never – 4.4%

8) Which of the following sportsbooks do you regularly use? (Select all that apply)

- FanDuel – 62.7%

- DraftKings – 66.5%

- BetMGM – 33.2%

- PointsBet – 20.0%

- Caesars – 20.5%

- Barstool – 18.0%

- BetRivers/SugarHouse – 10.6%

- WynnBET – 10.2%

- FOX Bet – 15.3%

- Other – 1.5%

9) Would you use an ESPN-branded sportsbook?

- Yes – 73.3%

- No – 10.9%

- Unsure – 15.8%

10) Would you trust an ESPN-branded sportsbook more than other options due to the name?

- Yes, much more – 33.2%

- Yes, somewhat more – 38.3%

- No, I would trust it about the same – 27.3%

- No, I would trust it less – 1.2%

11) What is your standard betting unit?

- Average: $171.69

- Median: $50

12) How many bets do you make per week?

- Average: 10

- Median: 4

13) Do you think you are profitable since you began betting on sports?

- Yes, I have won a significant amount of money – 13.0%

- Yes, I have won some money – 43.6%

- No, I have lost some money – 13.8%

- No, I have lost a significant amount of my money – 3.3%

14) Before legal online sports betting came to your state, did you bet on sports?

- Yes, through an offshore sportsbook – 21.5%

- Yes, through a bookie – 25.8%

- Yes, another way – 22.1%

- No, I didn't bet on sports – 30.6%

15) What matters the most to you when choosing a sportsbook?

- How valuable the sign-up bonus is – 21.4%

- How competitive the odds are – 23.2%

- How nice the user experience is – 18.3%

- How many ongoing promotions & odds boosts there are – 15.5%

- If I recognize the name – 6.2%

- How fast the sportsbook pays out – 15.2%

- Other – 0.3%

16) What is your primary reason for betting on sports?

- For entertainment – 48.3%

- To make money – 44.1%

- To compete with friends – 7.6%

- Other – 0%

17) How often do you typically place bets?

- Daily – 15.8%

- A few times per week – 50.3%

- Once a week – 21.2%

- A few times per month – 10.5%

- Once a month – 1.4%

- Less than once a month – 0.9%

18) Have you ever used a credit to deposit into your sportsbook account?

- Yes – 57.1%

- No – 42.9%

19) Asked only to those who answered “Yes” to Question 18: Have you ever gone into debt from using a credit card to deposit into your sportsbook account?

- Yes – 50.7%

- No – 49.3%

Methodology

The data from this study come from an online survey commissioned by Odds Assist and ran by online polling platform Pollfish from August 18, 2022 to August 20, 2022. There were a total of 660 respondents from the United States aged 25 and up. A screening question was used to make sure all respondents currently regularly bet on sports with a legal U.S. sportsbook (FanDuel, DraftKings, etc.).

>> Read More: Sports Betting Statistics